23+ Arizona Income Calculator

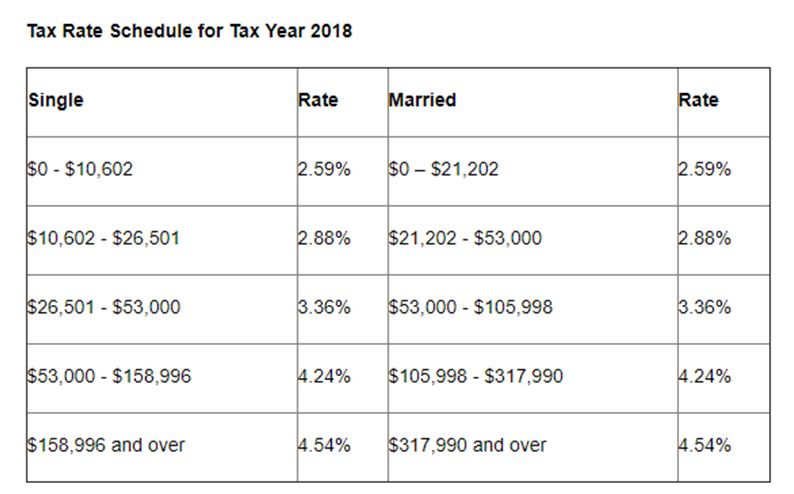

Your average tax rate is 1198 and your marginal tax rate is. For 100000 Annual income.

Arizona Income Tax Calculator Smartasset

Start filing your tax return now.

. Arizona Income Tax Calculator. Your average tax rate is 2041 and your marginal. Balance of withholding for the calendar year.

Its difficult to calculate net income without a SNAP calculator as there are additional deductions based on earned income and limits on amount of shelter-related. State income tax rate ranges from 259 to 45. However a professional is still.

The Arizona tax calculator is updated for the 202223 tax year. Arizona Income Tax Calculator 2021 If you make 70000 a year living in the region of Arizona USA you will be taxed 10973. The AZ Tax Calculator calculates Federal Taxes where applicable Medicare Pensions Plans FICA Etc allow for.

After a few seconds you will be provided with a full breakdown. No state payroll tax. Salary Paycheck Calculator Arizona Paycheck Calculator Use ADPs Arizona Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees.

The Arizona State Tax Tables for 2023 displayed on this page are provided in support of the 2023 US Tax Calculator and the dedicated 2023 Arizona State Tax Calculator. Arizona Income Tax Calculator 2021 If you make 200000 a year living in the region of Arizona USA you will be taxed 55807. This is only a high level federal tax income estimate.

Subtract line 5 from line 4. The state income tax calculator uses the most recent Arizona State income tax tables for 2023 and will give you an estimate of your tax obligations. Detailed Arizona state income tax rates and brackets are available on this page.

To use our Arizona Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. C1 Select Tax Year. Divide line 1 by line 2.

Estimate Your Federal and Arizona Taxes. Examples of payment frequencies include biweekly semi-monthly or monthly. TAX DAY IS APRIL 17th.

Arizona Arizona Hourly Paycheck Calculator Change state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and. Individuals receiving regularly scheduled payments from pensions or annuities that are included in their Arizona gross income may elect to have Arizona income tax withheld from those. This is wages per paycheck.

Divide line 6 by line 7. The Salary Calculator converts salary amounts to their corresponding values based on payment frequency. Has state-level standard deduction.

The Arizona Tax Calculator. Brief summary of Arizona state income tax. Have you paid taxes before.

How to Calculate Withholding.

Arizona Paycheck Calculator Smartasset

Updated Guidance For Arizona Individual Income Taxpayers Azbio

151 Plant Road Sinclair Wy 82334 Compass

Arizona Tax Rate H R Block

Santa Fe Springs Apartments 1717 West Glendale Avenue Phoenix Az Rentcafe

3357 W Thude Drive Chandler Az 85226 Mls 6494576 Azrmls

What Is Cdw Company Culture Mission Values Glassdoor

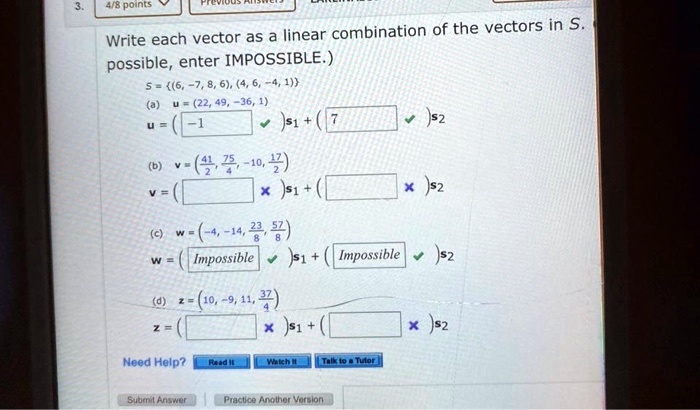

Browse Questions For Calculus 3

.jpg?width=850&mode=pad&bgcolor=333333&quality=80)

739 E Constance Way Phoenix Az 85042 Apartments 739 E Constance Way Phoenix Az Rentcafe

Zachar Law Blog Arizona Legislation

My Disney World Cost Calculator Our Total Price Travel With A Plan

3815 N 3rd Street Phoenix Az 85012 Mls 6310414 Azrmls

A 20ft Ladder Is Resting Against A Wall And A 4x4x4ft Cube How Far From The Wall Is The Base Of The Ladder And Where Does The Box Touch The Ladder

Browse Questions For Calculus 3

Ex99 2 010 Jpg

A Dit485b Htm

United States Us Salary After Tax Calculator